Employment reports are trickling in for the MBA Class of 2025. It's too soon to paint a complete picture of the job market, but there are a few interesting findings so far.

For example, tech seems to be on the comeback, entrepreneurship numbers look high, and the offer acceptance rates suggest that grads are taking longer to land the right role.

Here's what we know so far — and what to watch for as more schools release their data.

Which programs have reported so far?

As of mid-December, a few top MBA programs have released employment data for the Class of 2025:

Other M7 schools, including Wharton, Booth, and Kellogg, have yet to release their 2025 data.

Here are some of the highlights:

Tech is coming back?

Depending on where you look, tech offer acceptances are competing with – and in some cases surpassing – consulting as the top industry.

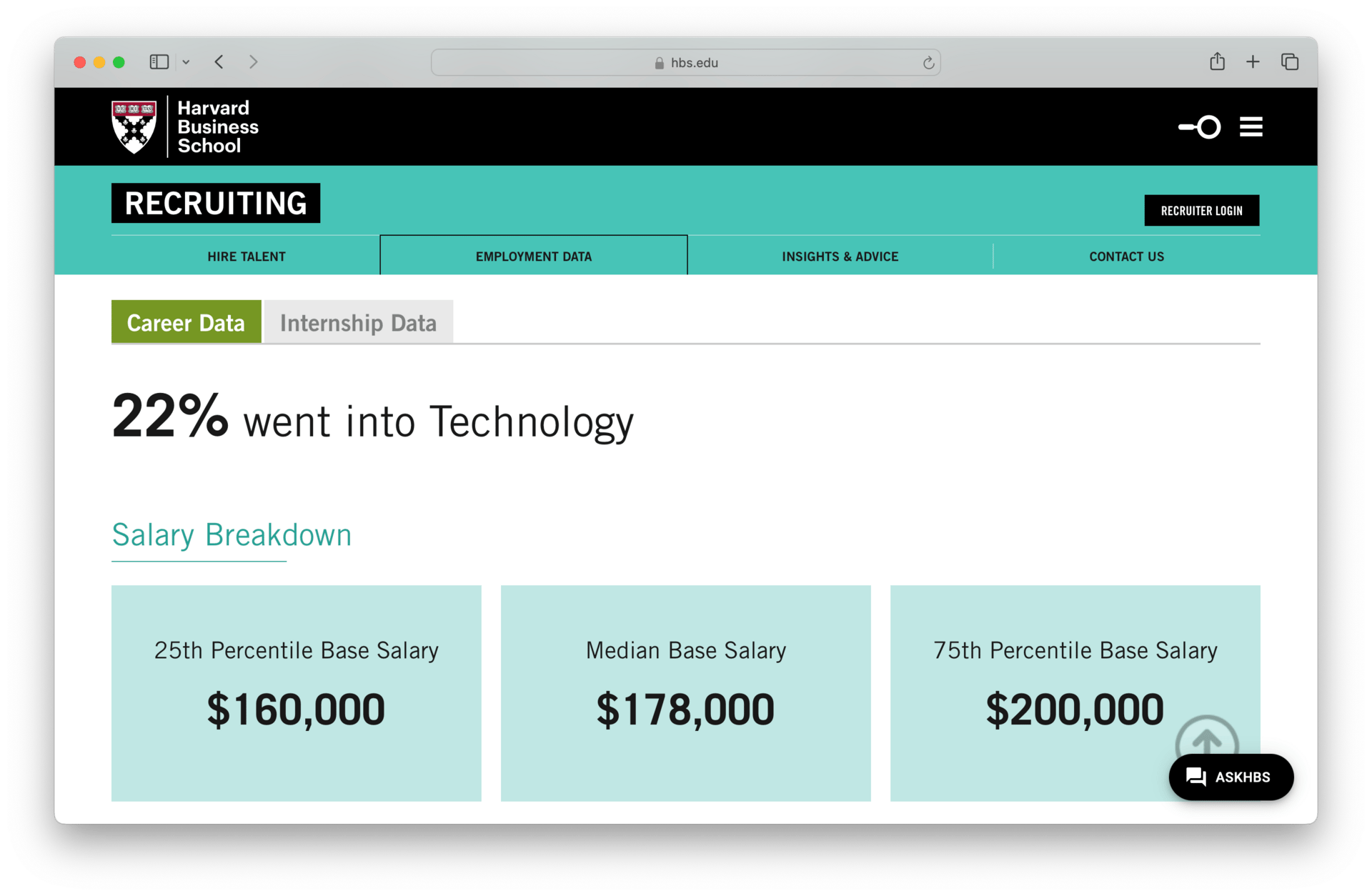

At HBS, which is not typically known as a tech hub, tech offer acceptances (at 22% of the Class of 2025) edged out consulting (21% of the class). That's pretty impressive for a program known more for finance and consulting. HBS grads joined companies like Anthropic and OpenAI, among others.

Source: HBS employment data (2025)

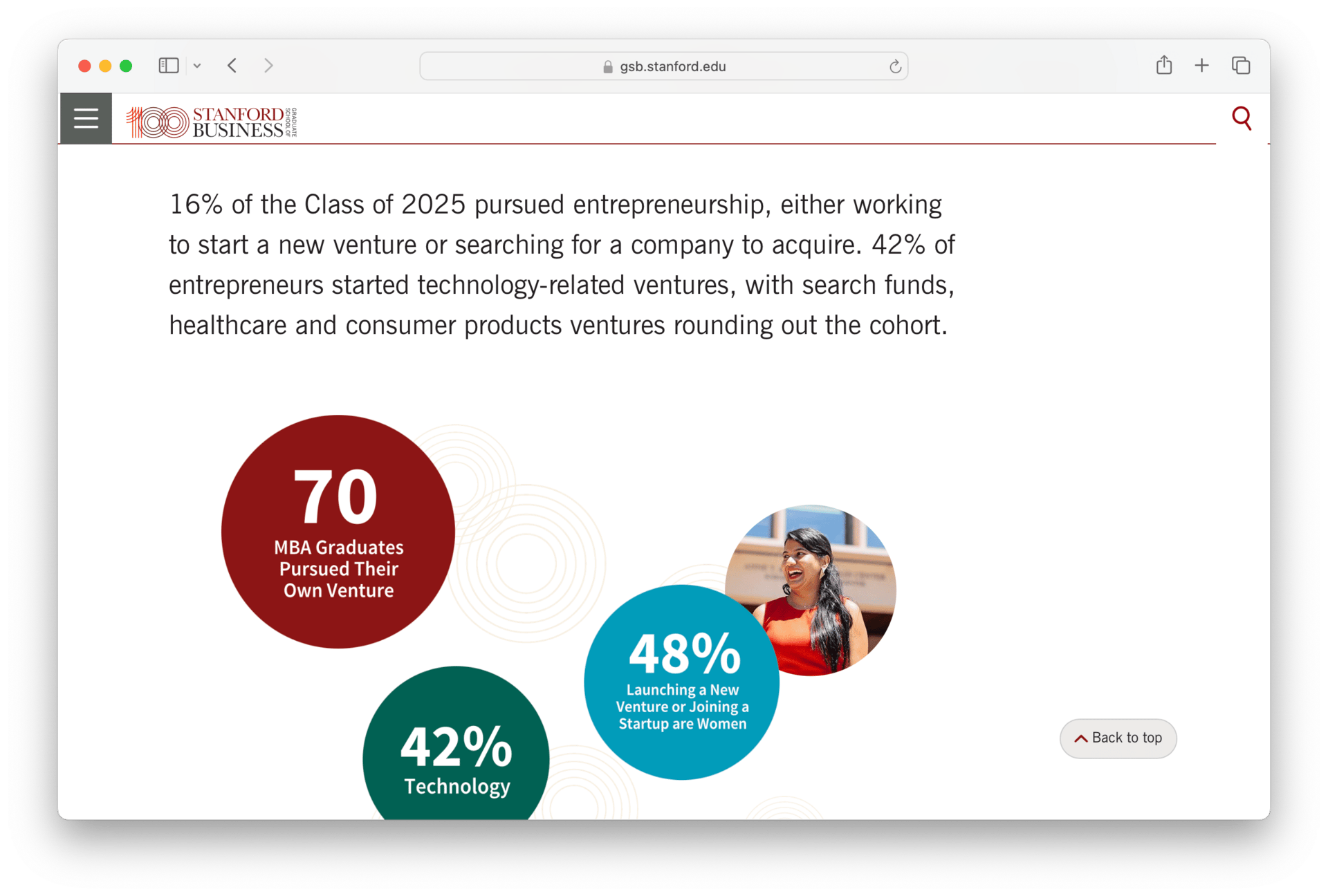

Stanford reported a "notable surge in graduates accepting opportunities in enterprise technology, fueled by hiring in AI-related organizations" with roles spanning product management, go to market, customer success, and sales. In addition to the 35% of grads who accepted offers in tech, 42% of Stanford grads pursuing entrepreneurship are building tech companies.

At UC Berkeley Haas, 39% of grads from the Class of 2025 accepted offers in tech. Haas grads joined large companies like Adobe, Google, NVIDIA, ServiceNow, Stripe, and other tech startups.

Darden isn’t particularly known for tech, but 16.1% of the class of 2025 accepted roles in tech. This is up significantly – from 8.8% of the Class of 2024.

The growth of entrepreneurship

HBS reported that approximately 155 graduates (17% of the class) are launching their own ventures, up from 14% of the class of 2024. Is entrepreneurship functioning as a placeholder category for graduates still seeking roles? It may be too early to tell.

Stanford saw similar numbers, with 16% pursuing entrepreneurship (70 grads).

Source: Stanford GSB employment data (2025)

Of course, not everyone who says they're starting a business will still be running one six months or a year from now. Some programs are more transparent about this than others, but it's worth watching whether these numbers hold up over time.

Employment rates show the realities of the market

The percentage of graduates receiving and accepting offers within three months of graduation might tell a clearer story than industry breakdowns.

Offers Received (+3 Months Post-Graduation):

HBS: 90%

Stanford: 90%

Darden: 90.2%

Haas: 85.7%

Offers Accepted (+3 Months Post-Graduation):

HBS: 84%

Stanford: 81%

Darden: 89.3%

Haas: 84.1%

For a challenging job market, these numbers are pretty solid.

The offer acceptance rates – consistently in the low-to-mid 80s at top programs so far – are lower than what we typically see. This means that graduates are being more selective.

Overall, we’re hearing that companies are taking longer to extend offers, and the market is tighter than it was a few years ago. No surprises there.

That said, these are still strong numbers. The vast majority of graduates who want jobs are getting them. It's just taking a bit longer, and students are waiting for the right opportunities, rather than accepting the first offer.

Compensation continues to climb

Median base salaries are strong and, in some cases, hit record highs:

Stanford: $185,000 (highest among reported schools)

HBS: $185,000 (up from $175,000 last year)

Darden: $175,000

Haas: $167,250

These figures don't tell the full story without considering signing bonuses, performance bonuses, and equity… but they do confirm that MBA compensation is trending upward.

From what we’ve seen so far, private equity might be the most lucrative post-MBA career path. At HBS, grads landing PE roles commanded a median $188,000 base salary, with a median performance bonus of $150,000. This may help explain why 14% of the class pursued roles in the competitive PE industry.

So, who’s hiring?

Most schools haven’t published comprehensive employer lists, but we have a few hints:

HBS graduates joined companies ranging from traditional consultancies and banks, like McKinsey, Bain, BCG, Goldman Sachs, JPMorgan, to AI-focused tech companies like Anthropic and OpenAI. Amazon, Apple, Microsoft, and Google also recruited at HBS.

Stanford saw significant placement in AI and enterprise technology companies, though the program didn’t release specific employer names in its report.

Darden’s employment report featured just a few large companies, like Amazon, Bain, Bank of America, Barclays, McKinsey, Strategy&, American Express, and Accenture.

Haas’s report featured just a few logos, including Adobe, Amazon, Bain, BCG, Deloitte, Google, Microsoft, NVDIA, and ServiceNow, among others.

Unsurprisingly, MBBs are dominant across all programs, alongside major banks and big tech companies.

Geography: Most grads are staying in the U.S.

Also unsurprisingly, the vast majority of grads from the Class of 2025 stayed in the United States:

HBS: 92%

Stanford: 95%

Darden: 98%

Haas: 967%

For HBS, 48% of the Class of 2025 stayed in the Northeast, while 24% headed West.

The majority of Stanford GSB grads (55%) stayed in the West.

Darden’s class was more evenly distributed throughout the U.S., with 25.3% staying in the Mid-Atlantic region, 25% of the class moving to the Northeast, and smaller groups moving to other regions.

Source: UVA Darden employment data (2025)

A significant majority of Haas grads (81.7%) stayed in the West, with the majority remaining in the Bay Area.

What we’re still wondering

These are interesting early indicators, but we’d love to know:

How did the rest of the M7 schools do? Wharton, Booth, Kellogg, CBS, and Sloan haven’t publicly released their data, so we’re missing key pieces of the puzzle.

How will six-month numbers look? Most schools report three-month employment rates, but outcomes typically improve significantly after six months.

What will happen with all of these entrepreneurs? How many of the ventures launched by HBS or GSB students will still exist in a year? Are students genuinely founding companies, or is this a temporary classification?

Is this an inflection point for tech hiring or a temporary improvement? Tech hiring rebounded after significant layoffs, but it still seems shaky when we read the headlines.

What does this mean for applicants?

If you're considering an MBA or currently applying, here's what to take from these early reports:

Tech is back, but selectivity matters. The increase in tech hiring seems promising, but it could be concentrated at FAANG companies and in AI and enterprise tech roles. Don't expect every tech company to be recruiting at the same intensity.

Consulting is still a reliable path. Consulting still captures 20-30% of most graduating classes. The MBBs are still looking for great talent.

Patience pays off. Grads are taking more time to land the right role, rather than accepting the first offer. If you're in the job search, this is normal and not necessarily a reflection of the program's strength or your candidacy.

Keep in mind that this data is from a point in time, and it doesn’t reflect any single program’s employment outcomes in 1, 2, or 3 years, when you graduate. No one knows what will happen!

What do we make of it?

It's still early, and the picture will sharpen as more schools release data.

These outcomes prove that the MBA degree still delivers strong outcomes, and grads are landing great roles at a variety of companies.

More schools will release employment data over the coming months, and we'll provide updates as Wharton, Booth, Kellogg, and other programs publish their reports.

Join over 4 million Americans who start their day with 1440 – your daily digest for unbiased, fact-centric news. From politics to sports, we cover it all by analyzing over 100 sources. Our concise, 5-minute read lands in your inbox each morning at no cost. Experience news without the noise; let 1440 help you make up your own mind. Sign up now and invite your friends and family to be part of the informed.